But you’d rather not refinance and pay thousands in closing costs. So, you’re stuck with a high monthly mortgage payment. Here's when you should consider refinancing your mortgage.Febru5 min read Can I lower my mortgage payment without refinancing? You'll also need to pay the fees and closing costs associated with creating a new loan. This requires a formal application and underwriting, and the lender will perform a new credit check. Refinancing will require you to apply for a new loan with a different structure, amortization schedule and interest rate. Should You Refinance Your Mortgage Instead? This can also be the case in a rising interest rate environment, where it's impossible to refinance at a lower rate than your current mortgage. This could be due to a change to your income, assets or credit profile that prevents you from qualifying for a new loan. Refinancing isn't a good option for your situation.Once the sale of your old home is complete, you can apply the proceeds toward your new mortgage without the need to refinance. You've purchased a new home before selling your old home.Applying this windfall to your mortgage helps lower your monthly payments, which allows you to keep more cash in your pocket every month. Here's when you should consider recasting your mortgage. Before recasting your mortgage, remember to consult with your tax preparer or CPA to determine the tax impact.

You'll also keep the original interest rate on your mortgage. You'll avoid credit checks or new underwriting, and the administrative fee will be significantly lower than the closing fees incurred through a refinance. Recasting your loan is an easier process than refinancing because it only requires lender approval, a lump-sum payment and a processing fee. There are key differences between recasting and refinancing a mortgage, even though both options can decrease your monthly payments. While a mortgage recast may not always be an option, a mortgage refinance is a valid alternative, depending on where interest rates are. When trying to reduce your monthly payments, the majority of borrowers will need to decide between recasting or refinancing their existing home loan. Typically, when the 10-year draw period ends, the loan is recast into a 10-, 15- or 20-year fully amortizing loan, depending on the terms of your agreement. Home equity lines of credit (HELOCs) will automatically be recast at the end of the initial draw period on the loan based on your outstanding loan balance. While most lenders and loan servicers don't publicly advertise whether they allow mortgage recasts, certain loans simply aren't eligible for recasts and some lenders won't permit them.

Finally, most lenders and servicers charge a nominal processing fee for recasting loans. Borrowers who want to access the cash will need to use home equity financing or sell the home. Depending on how much you're required to pay down the balance, recasting your mortgage also reduces your overall liquidity (i.e., cash on hand) because contributed funds will be tied up in the equity of the home. The biggest drawback of recasting a mortgage is that it doesn't shorten the term of the loan. Additionally, the annual percentage rate (APR) will stay the same, which is a benefit if you already have a low interest rate.

You also won't need to refinance or requalify for the mortgage, which means you'll avoid paying lender fees, appraisal costs, and title and escrow fees that are typically part of the refinance process. The greatest benefits to recasting a mortgage are lowering the monthly payments and reducing the interest you'll pay over the life of the loan. What Are the Pros and Cons of Recasting Your Mortgage?

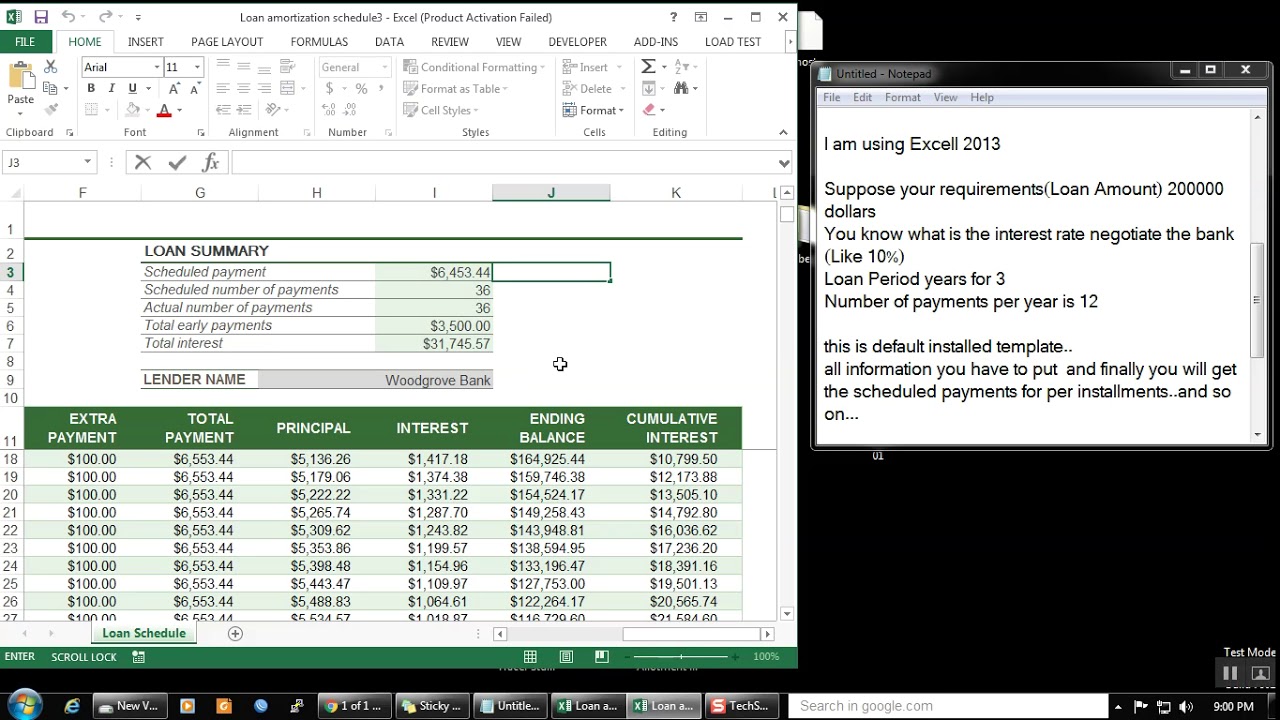

RECAST MORTGAGE CALCULATOR FULL

It's important to continue making your regularly scheduled payments in full until you receive confirmation that the recast is complete. As a result, it may take weeks to process your recast. This is usually only the case if the loan was transferred to another party since it was brokered. On occasion, lenders will also need approval from the investor that purchased the loan to complete the recast. Minimum payments vary from $5,000 to $10,000 or may be calculated as a percentage of the remaining principal balance, which can be as high as 10%. In order to complete a recast, most lenders and loan servicers require that you make a minimum lump-sum payment toward the principal balance of the loan. Most lenders and servicers charge a fee of up to $500 for processing the recast. You will have to make a formal request to your lender or loan servicer to recast your loan.

Additionally, not all lenders and servicers offer recasting services, so it is best to inquire with yours directly. of Veterans Affairs (VA) loans cannot be recast. Not all types of loans are eligible to be recast for example, Federal Housing Administration (FHA) and Dept.

0 kommentar(er)

0 kommentar(er)